The nail in the coffin was when RBI did not allow Mr Rana Kapoor-the founder of the bank to continue as Chief Executive Officer (CEO). This happened in September 2018. Sacking of CEO and the huge divergences being reported were enough indicators that something was not right at the bank.

To add to this, related party transactions between Yes Bank and promoter entities such as Yes Capital, Morgan Credits and ART Capital raised corporate governance issues. All evidences available pointed to something fishy with the banks books.

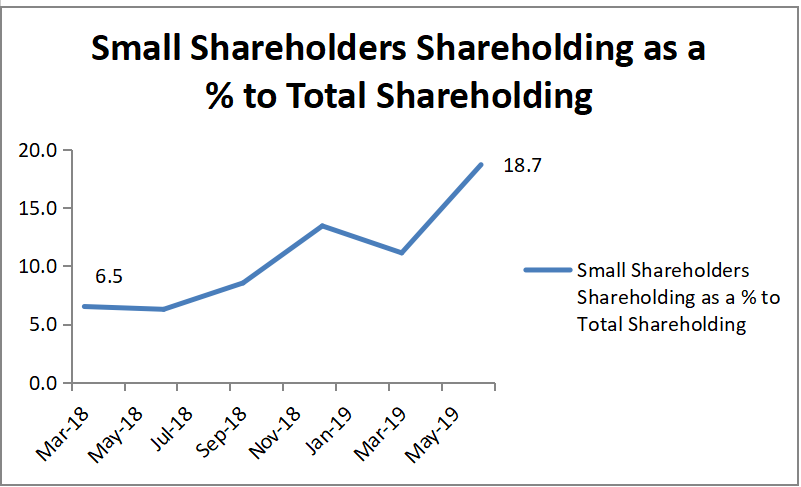

Fund managers sensed that something is wrong and started exiting the stock or reduced its exposure as reflected in this chart:

However, the data which will come now is going to shock you! Small shareholders holding almost tripled during this period.

Source: BSE Fillings

At every dip in the stock there were TV Analysts, neighbors, friends, relationship managers who advised that the stock had hit bottom. The golden words ‘the stock has hit bottom’ was heard at levels of 250, 200, 150, 100 and even now at 80. Retail shareholders went on accumulating and there was massive erosion in their wealth.

And such instances are seen time and again. Hence, we urge investors to stop tip based investing once and for all. It kills your wealth and more importantly your sleep.

So, if you stop tip based investing. Who will help you find good stocks?

We at Prudent Broking have launched a product named WiseBasket. Not only WiseBasket helps you to find stocks hand-picked by our research team, but also helps in making the correct allocation of these stocks in the overall portfolio. And the good part, it's absolutely FREE.

For more details, please do check out our website - www.wisebasket.com

Happy Investing!